A credit card in UAE on 4000 AED salary

Can you apply for a credit card if you earn AED 4,000 per month but have a good credit score? Ans: No, you need to have a salary of at least AED 5,000 per month to apply for a credit card in the UAE.

Can You Get a Credit Card with a Salary Below AED 4,000 in the UAE? It is important to understand that banks and other lending institutions in the UAE do not offer credit cards for a monthly salary below AED 4,000. In order to be eligible for a credit card, applicants must have a salary of AED 5,000 at least.

Credit card eligibility criteria, including the minimum salary requirement, vary among banks and financial institutions in the UAE. While a 4000 AED salary might be considered low for some credit cards, there are certain basic credit cards that may have a lower income requirement. However, it’s essential to note that the approval of a credit card application depends on several factors, including your credit history, debt-to-income ratio, and the specific policies of the issuing bank.

Here are a few general tips and considerations:

- Check with Banks: Different banks have different eligibility criteria. Contact various banks in the UAE to inquire about credit card options and their minimum salary requirements.

- Basic Credit Cards: Some banks offer basic credit cards with lower income requirements. These cards may have fewer features compared to premium cards but could be more accessible with a lower salary.

- Secured Credit Cards: If you have difficulty qualifying for a regular credit card, you might consider a secured credit card. Secured cards require a security deposit, and your credit limit is typically equal to the amount of the deposit. This can be a way to build or rebuild credit.

- Credit History: A positive credit history can enhance your chances of approval. If you have a good credit score, it may compensate for a lower income.

- Debt-to-Income Ratio: Banks often consider your debt-to-income ratio, which is the proportion of your income that goes toward debt payments. A lower debt-to-income ratio is generally favorable.

Before applying for a credit card, carefully review the terms and conditions, including interest rates, fees, and repayment terms. Additionally, ensure that you understand your financial capabilities and responsibilities when using a credit card.

A credit card in UAE on 4000 AED salary in 2024

Contacting the customer service or visiting the official websites of banks in the UAE will provide you with the most accurate and up-to-date information on credit card eligibility and requirements.

Currently, there is no financial institution in the UAE that offers credit cards to people earning a minimum salary of AED 4000. The minimum salary required for a credit card is AED 5000 for most financial institutions. If you earn below AED 5000, you will need two things to apply for a credit card.

First, you will need to have a savings of AED 3000. Please note that after you have applied for the credit card, you can’t clear the savings for a few days. Second, you should have a good credit score. You can apply for a credit card when you have the above two requirements.

My suggestion would be not to have any credit card for a salary below AED 4000 in UAE. Moreover, if you have a credit card your spending habits will be difficult hence it is not advisable to have credit cards.

A credit card in UAE on 4000 AED salary in 2024

In UAE, a credit card is not a must unlike in European and North American countries. If you are really willing to move around with less cash, the best option will be Debit Card and it is acceptable in almost all places in UAE provided if it is issued by VISA / Master Card.

A credit card in UAE on 4000 AED salary in 2024

For most of us Dubai ex-pats, owning a credit card is a common situation and a seeming impossibility especially. If you earn below AED 5,000, the minimum required salary to apply for a credit card in most, if not all, U.A.E. banks.

There are credit cards offered by Dubai Islamic Bank Al Islami Internet Credit Card and Arab Bank Internet Shopping. As the name suggests they are both internet shopping cards. For credit cards with more facilities, the minimum salary required is AED 5000.

Now, what if I told you that I, a below-5,000-salary-earner, was able to apply – and was recently granted – a credit card with a credit limit more than triple my monthly salary?

Before anything else, we advise everyone not to think of a credit card as ‘extra money to spend. Remember that when you have a credit card, you are borrowing money from the bank which means you are obliged to pay it (including other transaction fees).

What are some of the best credit card offers in the UAE?

Find, Apply and compare for the best credit card in Dubai and UAE.

Compare credit cards from UAE Banks, Compare Best Features, Best offers, Compare all the banks. Credit Cards offers, Rak Bank Credit Cards, ADCB Credit Card and more, Visa Card offers, Master Cards offer.

The Best credit cards in UAE – Top 5 Cards of 2024

- Emirates Islamic Cashback Plus Credit Card. – BEST FOR CASHBACK REWARDS – Earn up to 10% cashback on Supermarkets, Education, Dining, and Telecom

- HSBC Platinum Select Credit Card – BEST FOR BALANCE TRANSFER – For the first 6 months enjoy 0% interest on the balance you transfer, 6,12 & 24 months tenor is available with nominal fees

- ADIB Booking.com: The largest selection of hotels, homes, and vacation rentals Signature Card – BEST FOR TOURISM– 10% discount on hotels- 7% discount on car rentals through rentalcars.com-5% cashback on flight- 4% cashback on fuel spends & much more

- Najm Platinum Credit Card – BEST FOR MOVIE TICKETS – Buy 1 Get 1 Free at VOX Cinemas- 3% Cashback every Tuesday at Carrefour- 1.5% Cashback everyday at Carrefour. Save up to AED 200 every month – 0.5% Cashback everywhere Visa is accepted

- FAB Etihad Guest Credit Card – BEST FOR AIR TRAVEL -75% Etihad Guest Miles discount voucher- Receive 110,000 Etihad Guest Miles as a welcome bonus-over 900+ airport lounges access -Airport Pick Up and Drop Off Service & more

A credit card in UAE on 4000 AED salary

Credit cards are a way of life for many people here in the UAE and can either prove to be very handy for the wise spender or debt trap for those who are not careful with their spending. The lure of a credit card particularly gives deals in UAE, is very high as many ex-pats who move here are tempted by the flashy lifestyle and its accompanying trappings.

Fancy cars, expensive clothes, and eating out can exact a heavy toll on your wallet, but unfortunately are so common that many ex-pats opt for the credit card route in order to live the lavish lifestyle, little realizing that everything spent will ultimately need to be paid back.

Most banks and other financial institutions offer credit cards with spending limits that are two or three times that of your monthly salary, which is very attractive to many people. However, this means that to pay back the credit card dues, you would need to work for two or three months without spending any money on anything else.

Instead, opt for a sensible limit on your card so that expenses are manageable and can be paid off in a month’s time if required. Remember that all debts and loans in the country have to be paid off before you can relocate elsewhere. So being able to pay off your credit card bills in the future is extremely important.

What to look for in a credit card

Having said this, credit cards (if used sensibly) can be very effective in managing finances, earning rewards on everyday expenses, and maintaining your cash flow.

There are several criteria that should be considered before opting for a particular credit card:

- Interest rates: These should be carefully considered and may vary based on monthly salary and place of employment.

- Salary requirements: Most credit cards have a minimum salary requirement, so make sure that you are eligible for a particular card.

- Foreign currency rate: If you are a frequent traveler, consider how much extra you will be paying for transactions conducted in a foreign currency. Most credit cards will charge a fee that is a percentage of money spent on overseas transactions.

- Annual fee: Read the fine print. Many cards advertise “No Annual Fee” for the first year, but these do apply from the second year onwards.

- Other fees and charges: Look for these hidden fees such as late payment fees.

- Benefits offered: Consider the benefits offered such as air miles, access to airport lounges, cashback, and discounts in partner companies.

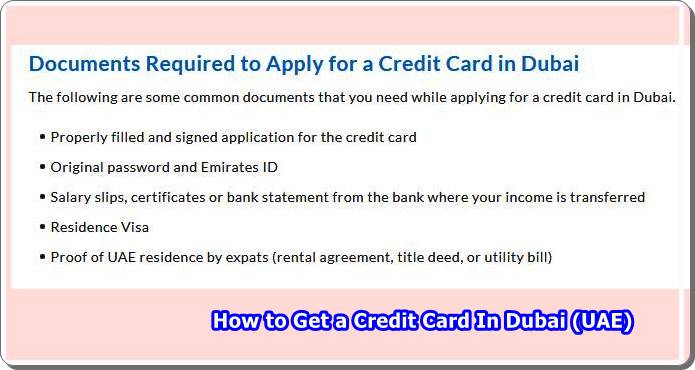

How to Get a Credit Card In Dubai (UAE)?

Get a Credit Card In Dubai

A credit card in UAE on 4000 AED salary

Compare credit cards

Need a credit card? UAE banks offer a wide range of credit cards. So it is important to compare all of them carefully to see which one is the best for you.

To find the best credit card, you should consider all items such as fees, rates, minimum salary applicable to each credit card, and more.

Whether you are looking for discounts for restaurants, cashback, airport lounge access or many other benefits, we will help you choose the most suitable credit card for you.

Leave the hard work on us and let us find you the best deals!

✓ Use the cursor to focus your search on the features you would like to have with your credit card

✓ Focus your search better by clicking on what is most important to you, whether it be requirements such as minimum salary, annual fees, or rate of return

✓ Looking for more of the details? You can read more information about each product by clicking on ‘View more details

✓ Find the right product for you? Click “Apply Now”, fill out the form and we will get back to you!

Why is the Tamkeen Card the best credit card you can get?

The Tamkeen credit card from Bank Albilad is a unique “Visa” credit card that allows the customer to buy what he wants from any store and then pay the due amount in easy monthly installments without any profit margin or increase!

The Tamkeen card is considered one of the best credit cards that offer the option of installments in a manner compatible with the regulations of the Shariah Board, as it offers its holder the best offers and discounts in easy installments, competitive annual fees and without any profit margin.

Apply now

What are the advantages of the Tamkeen credit card from Bank Albilad?

- Compliant with the regulations of the Shariah Committee.

- The possibility of paying the card in installments without calculating any profit margin or interest.

- Possibility to reuse the available balance.

- Pay the card in easy monthly installments of only 5% of the outstanding amount or 200 riyals (whichever is higher).

- Ease of adding the card in Apple Pay and Mada Pay

- Take advantage of Albilad Rewards Program to get various travel and tourism rewards, vouchers or even cash back!

- The ability to withdraw cash from the ATM (up to 30% of the credit limit).

- Possibility to use the card for payment at POS machines (up to 100% of the credit limit).

- Many ongoing and seasonal offers and discounts.

- Ease of using the card in online shopping with high levels of security.

- Possibility of early repayment of the amount due.

- Access to luxurious airport lounges: Experience the world of luxury in 25 airports around the world with the Platinum Tamkeen Card from Bank Albilad through the DragonPass program provided by the international company Visa. For more click here

- Protection: The card provides protection to the holder, as it covers medical and legal referrals, as well as purchase protection

- Extended Warranty: This service allows you to have the repair period guaranteed by the manufacturer’s warranty up to one year

A realistic example of a customer who purchased 15,000 riyals through a Tamkeen card

Ahmed went to a large shopping mall and bought a new mobile for 5000 riyals, then he bought clothes and electronic games equipment for 5000 riyals, then he withdrew a cash amount through an ATM for 1,000 riyals, after which he booked travel tickets and accommodation in a hotel for the weekend for 4000 riyals.

In the table below is the Tamkeen card payment mechanism and the automatic payment cycle for the amount that was used by Ahmed: (the maximum limit for the card is 15,000 riyals).

Tamkeen Credit Card Payment Mechanism

A very low monthly installment is deducted 5% of the amount due or 200 riyals, whichever is higher. Please find below an illustrative example of the payment process.

Payment is made automatically on the 25th of each Gregorian month.

Can the customer make an early payment for the card?

Yes, the customer can make a payment through the bank’s website and the Albilad app.

What is the point of sale usage limit for Tamkeen credit card?

100% of the available credit limit of the card. Subject to the cash withdrawal limit.

What is the cash withdrawal limit for Tamkeen credit card?

30% of the card’s credit limit.

What is the minimum salary?

For transferred clients, the minimum monthly salary is 3,000 riyals.

What is the method of calculating the profit margin?

No profit margin is charged on the card. See the following table:

| Number of months to repay the card | Minimum Payment | monthly profit margin | Annual Percentage Rate |

| 46 months* | 5% or 200 riyals, whichever is higher | 0% * | 0% * |

- Number of months to pay the card: Assuming that the credit limit of the card is 15,000 riyals, which is the upper limit, and the card has not been reused during the payment period.

- Monthly Profit Margin: No monthly profit margin is calculated.

- Annual Percentage Rate: Annual Percentage Rate (APR) is not calculated.

Best driving school in Dubai

How to start a business in Dubai without money

How do I get a Society of Engineers (SOE) card in Dubai?

What is the law for a VPN in Dubai?

How to get a freelance visa in Dubai?

A credit card in UAE on 4000 AED salary

Credit Card providers in the UAE do not offer credit cards at a minimum salary of AED 4,000, but you can take a lateral approach to obtain a credit card. However, you are advised to wait for your salary to reach AED 5,000 so that you can directly apply for a credit card and enjoy the true benefits of it.

How much do you need for a decent life in Dubai?

Chris works as a General Manager in one of the top firms in Dubai. He makes 60,000 dirhams a month. Has a lavish 3 bedroom flat in Marina. Drives a Lamborghini. Kids study in an international school. Chris throws lavish yacht parties every weekend. Chris only wears Armani suits and Cartier watches. He also carries a 22-carat gold-plated phone. Chris enjoys 7-star brunch with his wife. Chris has all that his heart desires. Yet, Chris has one complaint. “I wish my salary was higher.. Dubai is very expensive.”

Ruby works in one of the top firms in Dubai as a Housekeeping staff. She earns 1200 dirhams a month and an occasional tip. She lives in shared accommodation with 3 of her colleagues. She contributes her share to buy groceries and helps with preparing the food in a common kitchen. Her kids study in good schools back home.

Ruby spends her weekends talking to her family on Skype and loves reading ebooks. Ruby has saved enough money to buy 1 kilogram of gold for her daughter’s wedding. Ruby has a hard life. Ruby always says, “I’m thankful to be working in Dubai as I’ve been able to provide a better life for my family.”

There you see! You will need more than the amount of money you make in Dubai. At the same time, no matter how much money you make in Dubai, it will be enough!!!

Can I get a loan from Dubai banks? I have a 2500 AED salary.

Yes, you can get a loan, but not much because 2500 is the low salary in Dubai, but you can get loans from different banks

Is a monthly salary of AED 20000 (all inclusive) sufficient to sustain a family of 3 in Dubai? How does it compare with a monthly salary of INR 65000 in India?

How does it compare with a monthly salary of INR 65000 in India?

It is a good salary. A family of 3 would be you, your wife, and a kid. You can have a decent lifestyle. I shall break it for you:

1. AED 7000 – Rent (1 or 2 BHK depending on your area). Not the posh areas but decent areas.

2. Electricity + water + sewage (DEWA) – AED 600 – 700. Try to get an apartment where the chiller is free.

3. AED 3000 – food. Suppose you cook at home with the best ingredients.

4. AED 300 – Cable, internet.

5. AED 1000 – Travel (to and fro to work by bus or metro).

6. Schooling for the child – AED 2500 – AED 4000.

7. AED 500 – Entertainment (twice a month).

8. AED 200 – Medical expenses (which are not covered by your insurance).

9. AED 500 – Clothing, etc.

10. AED 1000 – Misc. expenses.

Total around – AED 15000. Savings – AED 5000 = Rs. 80000+.

All expenses are on the higher side, except rent and travel. Your DEWA bill depends on your rent. It is a minimum of 5% of your monthly rent. If you live smartly (cheaply), your expenses can also decrease. If you want to splurge in Dubai, the sky is the limit. AED 20000 is a better salary than Rs. 65000 in India. And, yes, no Income Tax.

EDIT: By all-inclusive, I hope this is what you are getting cash in hand. I am not calculating Air travel to India or elsewhere. In the case of India, for 3, it could be anywhere between 1500 – 3000 AED. I also hope your employer pays you and your family yearly tickets, which are not included in your take-home.

I hope they are also paying you one-time moving expenses. It shall help you buy furniture and other appliances for your home. Some employers also pay tuition fees for kids. Check your contract; it should have details. If your workplace is near the Sharjah border, I suggest you live in Sharjah as you shall get apartments a lot cheaper there; 50K for 1 – 2 BHK in very good areas.

But your traveling expenses shall increase a bit. A lot of permutations & combinations. DO NOT take a decision just based on my answer. It is your and your family’s lives. But saying that, Dubai is a lovely and extremely safe place to live. Good luck!

Edit 2: The cost of living has increased substantially in Dubai since I wrote the answer. Please do check before accepting any offer about the general points. AED 20000 is still okay, but the savings might be lower if you maintain the same lifestyle I discussed earlier. June 7, 2016.

I have received an offer from Dubai of 12000 AED per month plus benefits. Should I go for it?

Should you go for a 12,000 AED job? It all depends on your designation, work experience, and spending style. And what benefits you get?

Alright, Here are a few facts.

If 1 bedroom Apartment is sufficient for you, it would cost 3.5K to 6K per month in Dubai. If you consider staying in Sharjah, you will need more time traveling. Dubai traffic towards Sharjah on the eve (and from Sharjah in the morning) is very high. If you need a 2 BHK, it would cost 4.5K to 8K, depending on the location and building. If you think of sharing a flat with someone, you can save a lot in terms of money.

So let’s talk about other expenses.

- DEWA (Electricity, water, sewerage + Building tax) – 1000 AED in summer and 500 AED in winter.

- Etisalat/Du Phone Bill: 150 AED post-paid plan (for 300 flex minutes+6GB data (1 GB normally, 6 GB if you sign a 2-year contract))

- Envision/OSN (Home Wi-fi+Basic TV channels + a Landline): 300–400 AED.

- If you plan to take the Metro, Travel expenses are 300–600 AED per month. If taxi (no idea I could not sit in a taxi peacefully. I always look at the taxi meter)

- If you have a Car, you need a driving license – it would cost around 7K to 9K to get one.

- If buying a car, then a 3-year loan would make you pay around 1.5K to 3K, depending on the chosen medium-range car. + insurance every year (around 2k-4k), service cost. Car wash – 100 AED per month.

- Petrol cost – again depends on your distance to Office and travel req.

- Salik – (or road tax) and Fines extra.

- If a company gives, WOW!

- Groceries: If you cook, 300 – 3k depending on your dependents.

- Eating Out: It can cost a lot if you do not plan properly.

- Shopping: 1K- infinity every month.

A credit card in UAE on 4000 AED salary in 2024

So… 1000 (Dewa)+150(mobile)+400(home internet,tv)+500 (travel)+500 (groceries)+300(eating out)+1000 (misc. shopping) = around 4000 AED. (for a 1bhk, 2 people family)

4000 AED + house rent of let’s say 4000 = 8000 AED.

Balance 4000 AED. (12,000 Salary- 8000 monthly expense)

From this, you have to keep the money for Emirates ID (like an Aadhar card), good conduct certificate(200 AED), bed, tv, cot, driving license, sofa, dress, laptop, and iPhone (these all become necessity later), savings, leisure travel, etc.

If you have a child (of school-going age), then education is very costly here. Again, monthly, 1K -5k, including school and bus fees, depending on the school.

And, you mentioned salary+benefits. Normally, benefits include medical insurance and tickets.

- Companies normally give Medical insurance for yourself. (if you are married, ask for the family because it is costly and mandatory).

- They give an “Up and down flight ticket” to your home town once a year. ( Ask for the family as well. If single, ask for two times a year).

- Ask for school fees for your children. It is very costly.

- Ask for house rent allowances extra (Not from 12K).

- Ask for a car.

But, getting a work experience from a different country is always good. Good to work for 4–10 years. So, try it out.

What is a good salary in Dubai for a family of 2 people and 1 baby?

That living costs in Dubai are rising every year. 8,000 AED is barely the minimum to sustain a good life. However, I still see so many living off for less. I was still in Dubai during the unfortunate 5% VAT introduction, and while that may feel like nothing when you’re purchasing small grocery items for 5 AED, it feels a lot for more expensive needs.

Also, I’ve noticed that this answer got a lot of traction and views, and unfortunately, for those who are reading it now, it’s not updated. Right before my husband and I left the UAE, we no longer lived on 8,000 AED per month. We already needed double the amount (minimum) as the prices skyrocketed, and eventually, your needs and lifestyle changed.

Dubai has that effect; it sucks you into the materialistic culture (that I used to despise with all of my heart). After years of living there, it seems like nothing else to do except go to the malls, shop, dine out in overpriced restaurants, or go out with overpriced drinks. I couldn’t take it anymore, and my husband and I realized it was about time we left.

A credit card in UAE on 4000 AED salary in 2024

However, Dubai gets a really bad rep for being expensive, but ever since moving here to Dublin, it’s the exact situation, even worse. It’s not just expensive Dubai, but every country has been experiencing some serious inflation over the past couple of years.

I researched apartment rates recently and am surprised that most of them have decreased! When my husband and I lived in a studio apartment in Dubai Silicon Oasis, we only paid AED 36,000 (because we paid one cheque, expected to pay more for four cheques, etc.). Now, the same studio apartment is being offered for AED 32,000; some even go down to AED 30,000! My friend called it the supply-demand issue, as many new apartments are constructed, but not enough renters or buyers to sustain it.

P.S. I recommend Dubai Silicon Oasis as an area for those with children. The apartments are spacious; there are good private schools nearby; the place is peaceful and quiet, and it feels like a haven away from the chaos that is Downtown Dubai except for the fact that the area is only 20 mins’ drive away. Transpo might be an issue for some (especially those without cars), but for those that have access, it’s a great place to live with your family.

A credit card in UAE on 4000 AED salary in 2024

Hello, having lived here in Dubai since 2015, I can say that one’s definition of a “good” salary should be commensurate with your lifestyle choices. I live with my husband, and although we don’t have a child, 8000 AED per month is enough to get us by and cover all our expenses, including food, accommodation, transportation, and utilities (leisure and shopping not covered, of course). It also matters whether two people will be earning or would it be only one who will be the breadwinner.

One of the biggest expenses in Dubai is rent; unfortunately, to many, this takes up about 50% of their salary (if conjugal, maybe down to 30%). Renting out a unit for a year is usually cheaper than renting out every month. A one-bedroom apartment should be apt because you already have a child. It normally costs 50,000 – 80,000 yearly, depending on the area, and DEWA also depends on the condition of the building, so give it an additional 12,000/ yearly at most.

Food is not expensive but also not cheap in Dubai. Dining out is expensive, but doing grocery is a cheaper alternative. But this largely also depends on where you do your groceries.

Carrefour and Union Coop is cheap, while Spinneys and Waitrose are on the other side of the sphere. Toiletries are also so-so here, but expect your wife to pay more for her makeup and beauty needs than in your home country.

A credit card in UAE on 4000 AED salary in 2024

Your baby’s needs here are also very costly, as well as education (depending on which school you decide to send them to, there are options for both of the spectrum). Friends told me that preschool yearly tuition costs 30,000 AED, and that’s only preschool! So that is another thing to put into consideration.

They say buying a car is cheaper in Dubai because oil is very cheap here, but the problems are fines here are very hefty (and traffic rules are very strict), getting a license costs a lot of money, and traffic is very time-consuming. Commuting via public transportation is preferred since it is cheaper and worry-free.

Lastly, shopping and leisure activities are costly here and essential to your well-being. Gym memberships, weekly shopping sprees, and dinner dates can add up quickly; before you know it, you have more bills to pay than you have ever saved (from our experience). So better be wise about how you will spend your hard-earned money.

In conclusion, with a thrifty lifestyle and sending your kids to public schools, 10,000 – 15,000 AED monthly will do you just fine. But if you want to splurge on your children’s education or get a more luxurious flat in a posh area, you will need 20,000 – 50,000 monthly to survive. But in the end, that will depend on you.

A credit card in UAE on 4000 AED salary in 2024